Instalment payment option for social security contributions and taxes

Social Security, Withholding Tax and VAT

(updated 14/04/2020)

This document was updated on the above date. Nevertheless, and as has proved necessary in recent days, its contents may be altered as a consequence of the publication of new legislation.

The taxpayer must elect to make phased payments over a 3 or 6-month period at both the social security and tax portals. As of today, this option to phase payments over a 3 or 6-month period is not yet available on either the Portal da Autoridade Tributária (tax office portal) or the Portal da Segurança Social Directa (social security portal).

The analysis of billing referred to below is based on the billing SAFT.

Form 22, IRC (corporation tax), Special Payment on Account and Payment on Account

Normal Deadline | Postponed Deadline | |

| Special Payment on Account | 31 March | 30 June |

| Form 22 2019 | 31 May | 31 July |

| IRC 2019 | 31 May | 31 July |

| 1st Payment on Account | 31 July | 31 August |

- The due dates for the 2nd and 3rd payments on account have not yet been confirmed.

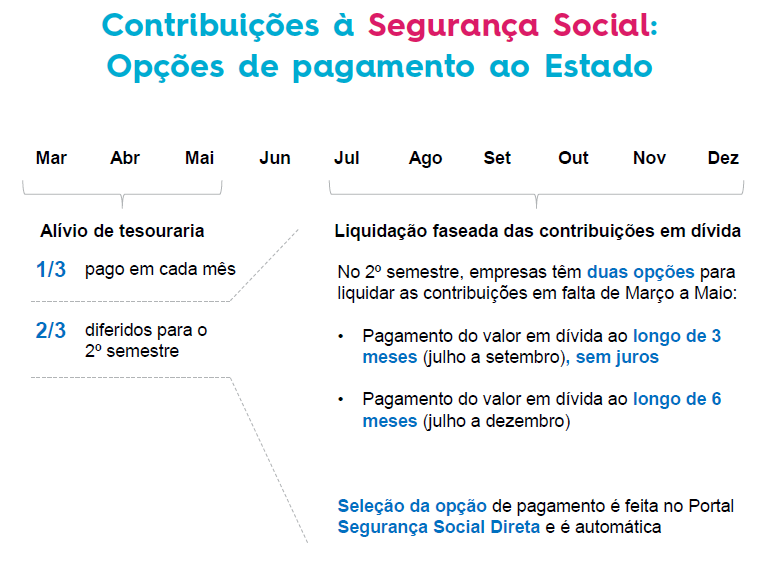

Social Security Contributions

- Companies may pay their social security contributions in instalments over 3 or 6 months. That is, they may defer the 23.75% charge (paid by the business).

- The 11% (employee) contributions may not be paid in instalments.

- If one instalment payment is missed, the company will lose its entitlement to pay its dues in instalments.

| Who can benefit? |

|

| Which payments may be made in instalments? |

|

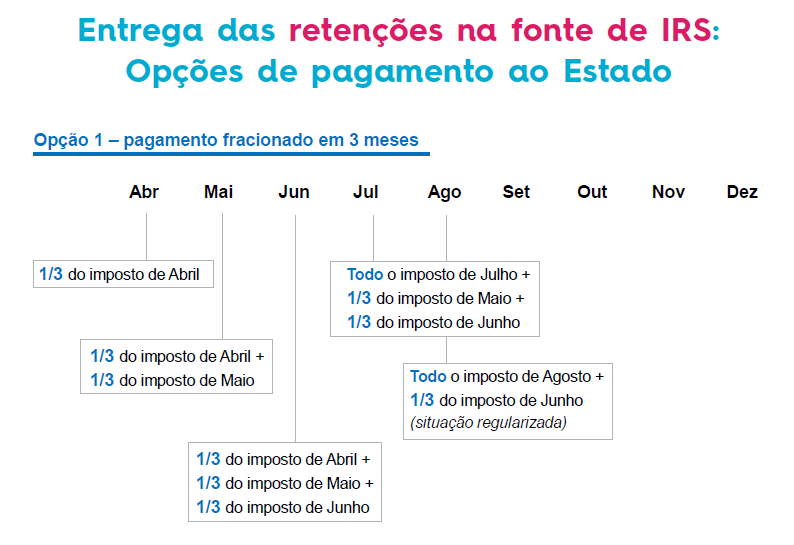

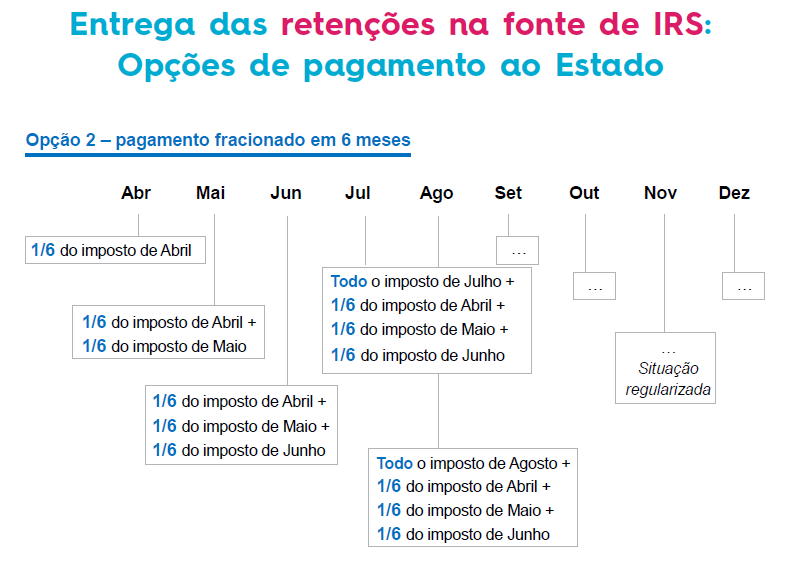

IRS (income tax) and IRC (corporation tax) Withholdings

| Who can benefit? |

|

| Which payments may be made in instalments? |

|

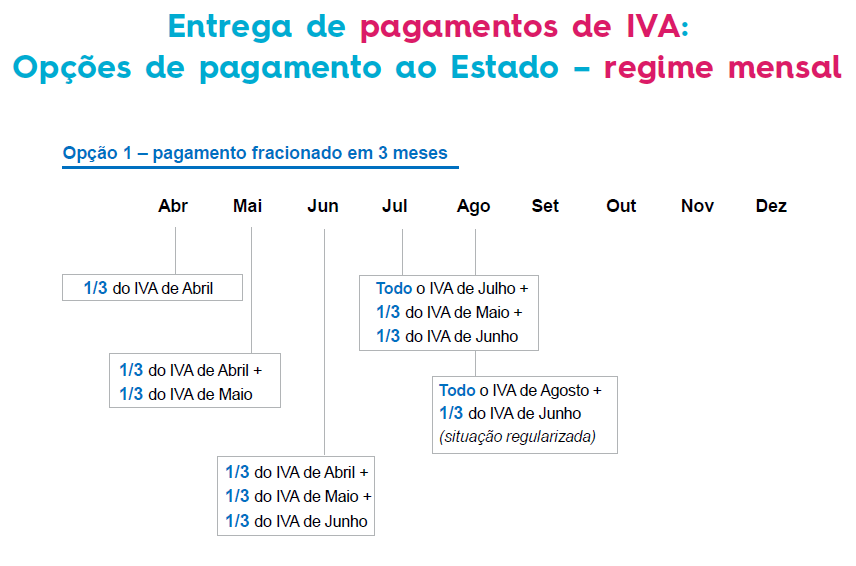

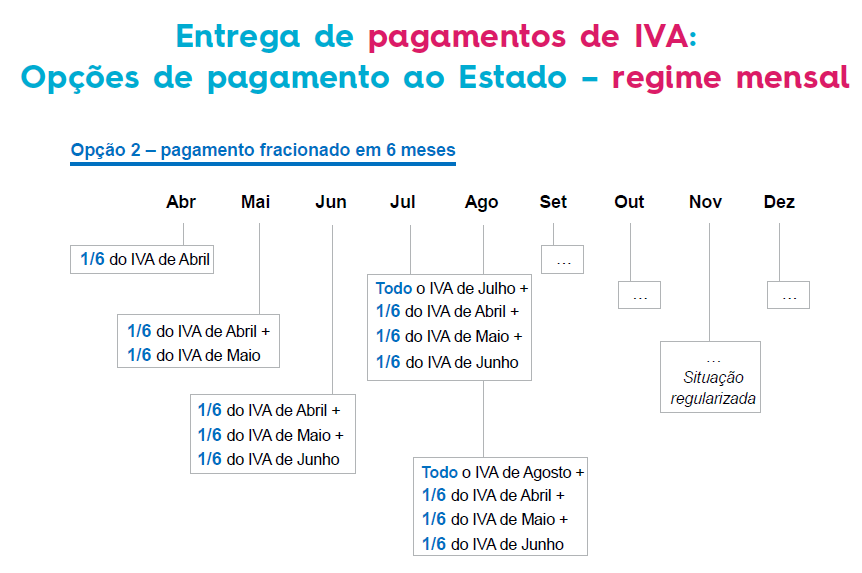

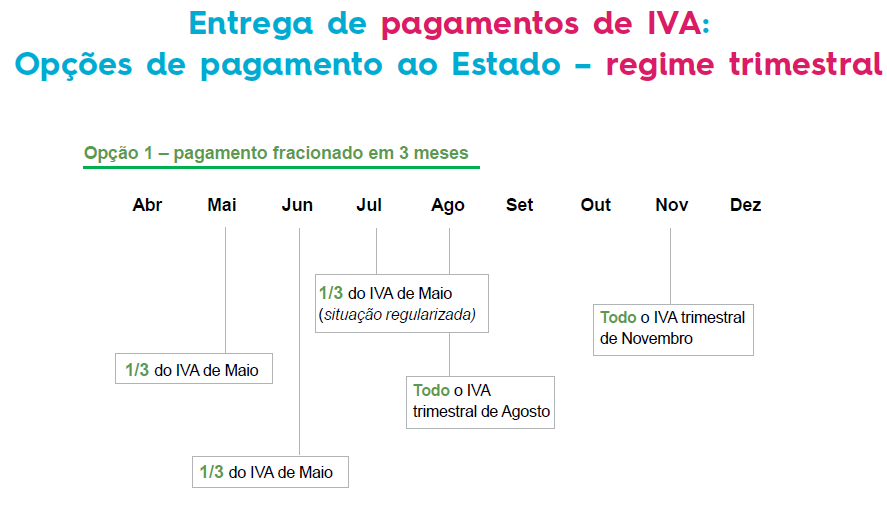

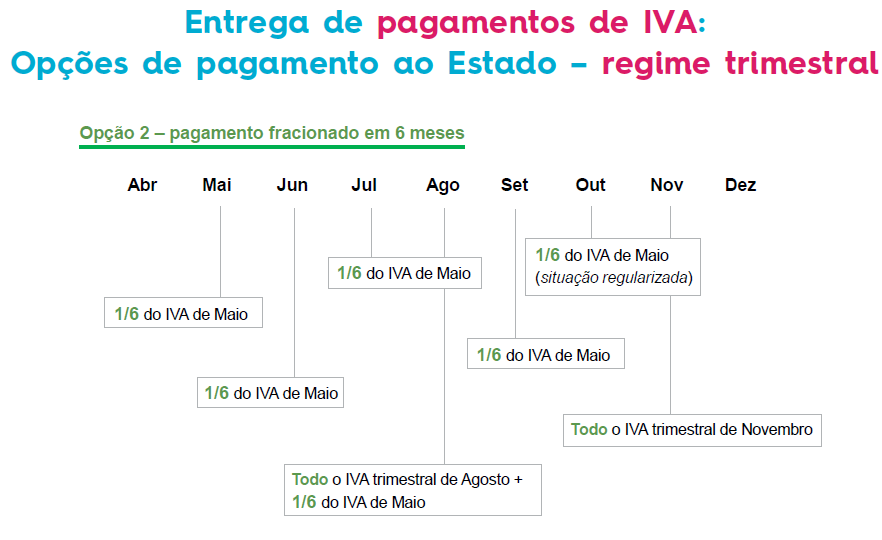

VAT

| Who can benefit? |

|

| Which payments may be made in instalments? |

|